-

Welcome to Donor Services Online!

This quick tour is designed to help you find your way around the site.

-

Navigation

You can click on a top-level navigation item (such as "Help" to go directly to that section OR roll over it to see sub-sections. Navigation items with sub-sections have a small triangle next to them.

-

My Grants

The Grant section features improved search results to simplify choosing an organization.

-

Messages

View confirmations and other communications from Donor Services in the Message Center.

-

Mobile Friendly

The site has also been optimized for mobile. Try it out on your iPhone or Android device.

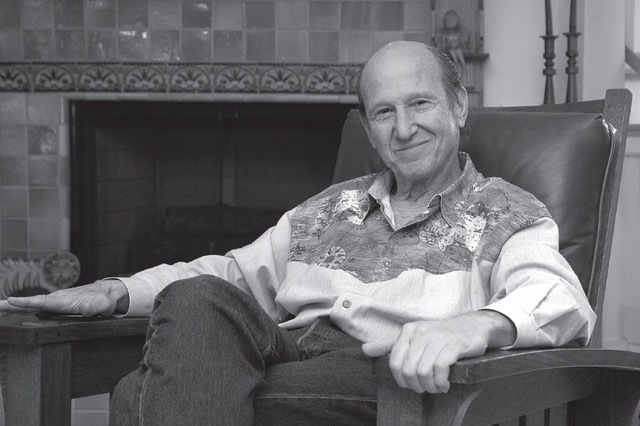

Bruce Whizin Memorial Fund

Bruce Whizin Memorial Fund

The Bruce Whizin Memorial Fund was established to celebrate and honor the life of Bruce and continue his legacy – he left this world better than he found it. He supported many communal institutions including Adat Ari El, the American Jewish University, Camp Ramah, and the Jewish Community Foundation his whole life. Contributions made to the Fund will help support the care of those suffering from dementia, as well as the Jewish Community Foundation, where he served as an Advisory Board member for many years.

Thank you for helping us ensure Bruce’s legacy of kindness and generosity.

Much love and gratitude,

The Bruce Whizin Family

Bruce leaves behind his sons, David, Brad (z"I), Gary (Alicia Garcia), Adam (Kate Maloney); and his daughter, Sarah (Mike) Schultz and his dear, former wife Shelley Whizin; beloved friend and former partner of 18 years, Leslie Lopata. His greatest treasures were his grandchildren: Akbar, Nate, Amber, Hana, Ralph, George, Cameron, Killian, Melia, Jordyn, Jake, & Zoe.

Contribute Today

Your tax-deductible donation to The Foundation will be credited to the Bruce Whizin Memorial Fund to support 501(c)(3) non-profit organizations recommended by Family and Bruce Whizin.

The Jewish Community Foundation of Los Angeles ("Foundation") is a registered 501(c)(3) non-profit organization. Contributions to The Foundation are tax-deductible. The Foundation's tax identification number is 95-6111928.

Family and friends ("Advisers") created this charitable Donor Advised Fund ("Fund") at The Foundation in honor or in memory of a loved one(s). Fund Advisers and their families may not personally benefit, nor direct specific individuals to benefit, from the Fund. Advisers may recommend grants from the Fund to 501(c)3 nonprofits, Jewish or otherwise, locally, nationally and in Israel. The Foundation legally controls the Fund and vets all grantees. View or download information about Donor Advised Funds.

Tax receipts for online donations are available immediately via email and download. Credit card donations incur a convenience fee of 3%, although the entire credit card donation amount is tax-deductible. For example, for a $100 credit card donation, $97 will go to the Fund, $3 will pay our processing vendor and $100 will be listed as a tax-deductible donation on your tax receipt. If you prefer to donate via check or donate securities or other assets, view Giving.

Established in 1954, the Jewish Community Foundation of Los Angeles manages charitable assets of more than $1 billion entrusted to it by over 1,300 families. The Foundation partners with its donors to shape meaningful philanthropic strategies, magnify the impact of giving and build enduring charitable legacies. Over the past 15 years, The Foundation has distributed over $1 billion in grants to thousands of nonprofits across a diverse spectrum.

Visit us at www.jewishfoundationla.org. Contact us at development@jewishfoundationla.org or (323) 761-8704.